Errors are common in any filing process. There may be many reasons. Filing returns in huge numbers. Managing to file returns at the last minute. Not being extra cautious in handling numbers. And none to be blamed. You have a way to correct your filing errors. IRS gives you the option to rectify errors.

Get to know about the amendment/correction form, Form 941-X right here.

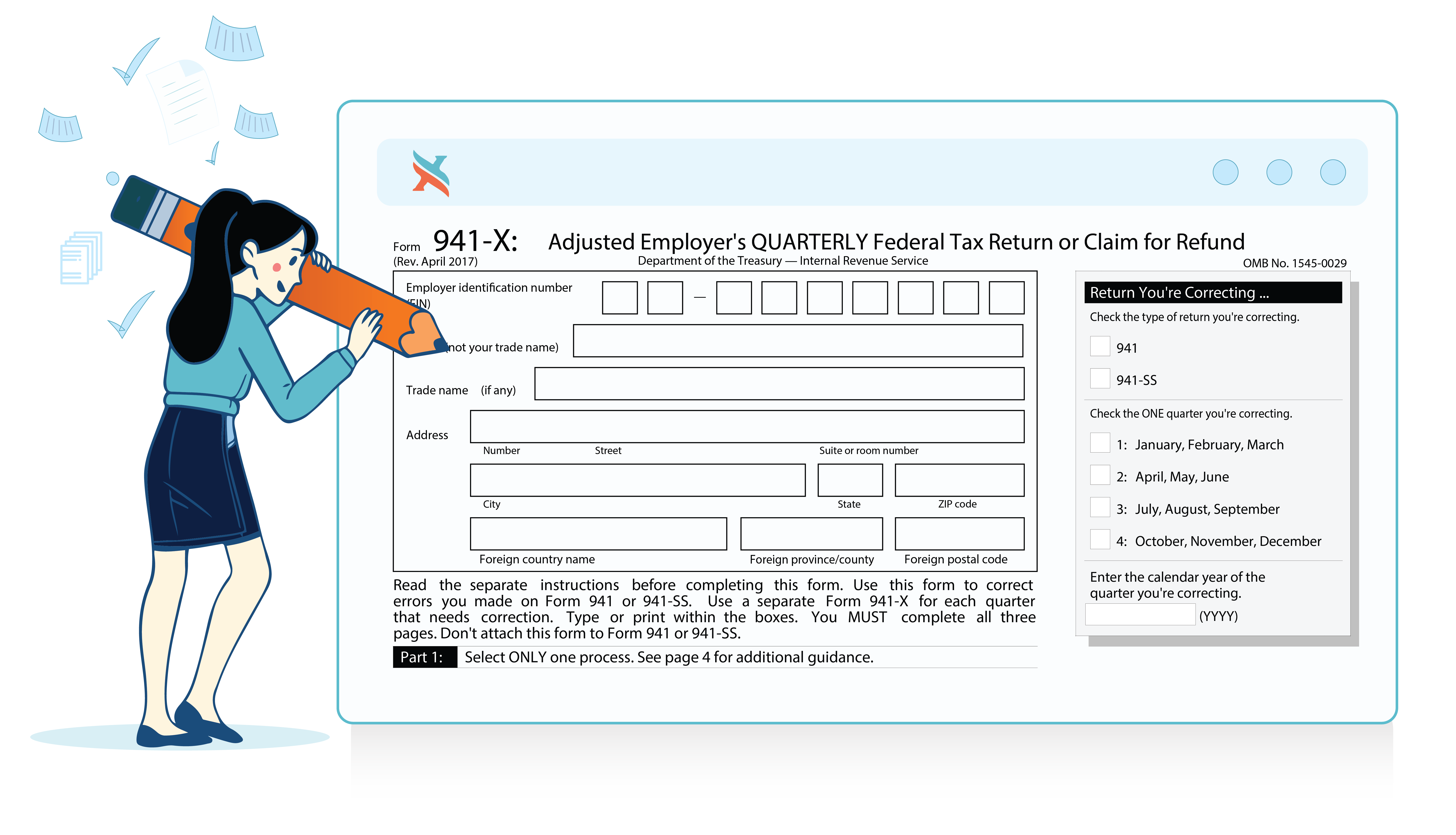

What is Form 941-X?

Form 941-X is the Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund Form. If you have discovered errors in your previously filed 941 you can correct or amend it using Form 941-X.

You have to file separate Form 941-X for each quarter for which corrections are to be done.

You must make payments along the Form, if you are filing for underreported taxes. When reporting overreported taxes, you can either claim a refund or make a credit for your next return.

What is the deadline to file Form 941-X?

The deadline to file your Form 941-X is based on the time you discover the errors.

If you have discovered errors in your 941 in the current quarter, then file your Form 941-X by when the quarter ends. At the most, you can correct the underreported amounts within three years from the date original Form 941 was filed.

For overreported amounts, file form 941-X as soon as you found the error. You have to file 90 days before the limitation on your credit or refund expires.

Errors that can be corrected using Form 941-X

Errors that can be corrected using Form 941-X are

- Employee Wages, tips, and other compensation

- Income tax withheld

- Taxable social security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding

- Qualified small business payroll tax credit for increasing research activities

If errors are related to the number of employees receiving wages or part 2 of the form, you need not file Form 941-X.

Overview of Form 941-X – Part 1 to 5

Form 941-X is a four page form where the last page is a process explanation given in simple breakdowns. Pages 1 to 3 has

- Part 1: You have to check one of the boxes based on the adjustments or claim.

- Part 2: It also has checkboxes to get clarification on overreported and underreported amounts that you are going to adjust or claim.

- Part 3: It is the same as your Form 941 where you can now enter the correct values which you want to fix. Double check if the entries are correct.

- Part 4: You will have to give a detailed explanation about the corrections you made.

- Part 5: The 3-page form is valid only if you sign in Part 5.

What is the method to file Form 941-X with ExpressEfile?

Filing your 941-X is quick, simple, and secure with ExpressEfile. The steps to file 941-X with ExpressEfile is as follows.

- Click ExpressEfile and sign up with basic information.

- Choose Form 941-X.

- Fill in Pages 1 through 3.

- Generate, download, and print the forms.

You can send the printed forms to the IRS.

Where to send 941-X Form copies?

The mailing address to send your form copies changes based on your location. Check the link for your Form 941-X mailing address.

For any queries on Form 941-X, check the Form 941-X FAQs here.